How Nuon v2 Works: A Guide for the Stablecoin Holders

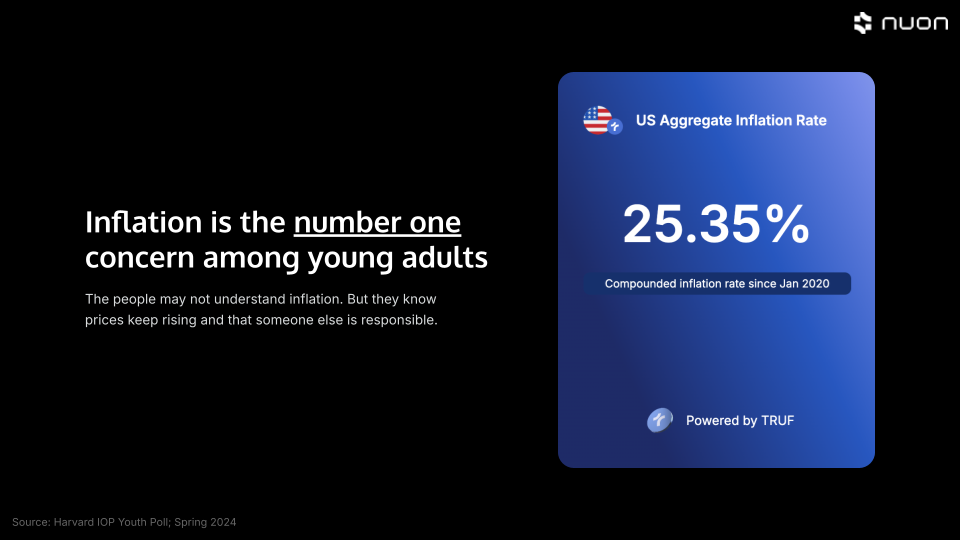

Nuon is a decentralized stablecoin designed to protect holders from inflation in an easy and risk-adjusted way.

We simplified everything so that the non-DeFi-natives can gain access to DeFi yields and continue earning yields without further attention or action required.

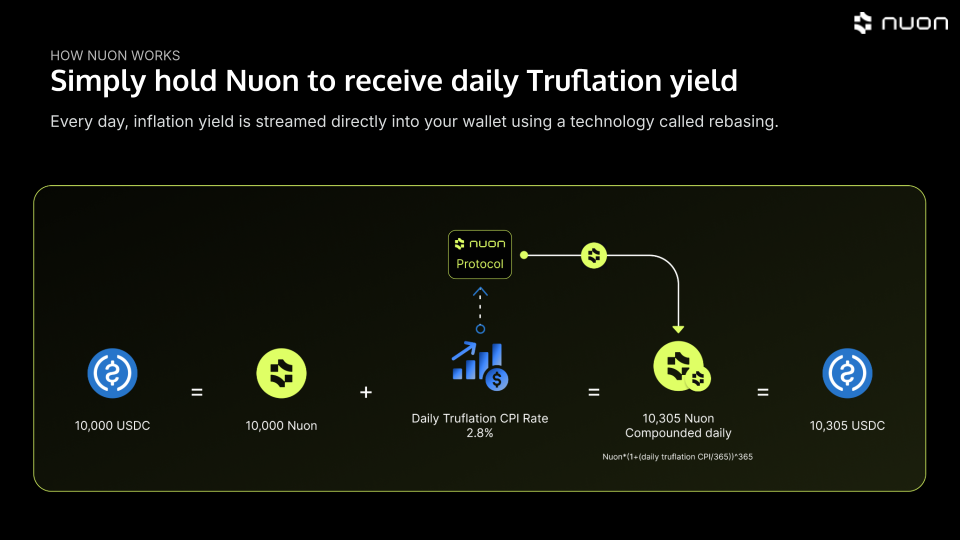

Minting

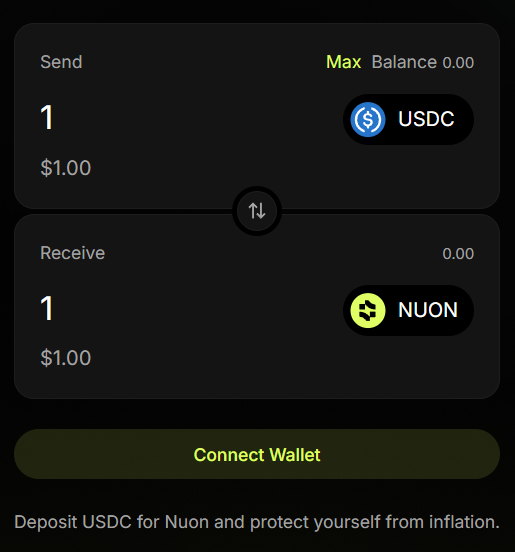

Users can mint Nuon by depositing USDC (a stablecoin pegged to the US dollar) into the protocol at a 1:1 exchange for Nuon.

Nuon V2 is first launching on the Base chain, a Layer 2 of Ethereum. This means that to obtain your Nuon, you'll need a non-custodial Base-compatible wallet, USDC bridged to the Base chain, and some BASE token to cover the transaction gas fees.

You can mint Nuon directly on the Nuon v2 dashboard using a simple swap transaction and following the instructions of your wallet.

If inflation hedging was all you needed, then you are set. You just received Nuon V2 in your wallet, and the inflation yield will be paid there using a rebase mechanism. You'll receive a yield equal to the current inflation rate (as measured by Truflation) paid out in Nuon for as long as you hold Nuon. It will result in a compounding effect, where your wallet has more and more Nuon, so you receive more and more yield.

*No negative inflation is ever applied. Nuon V2 rebase only applies to positive numbers.

Staking

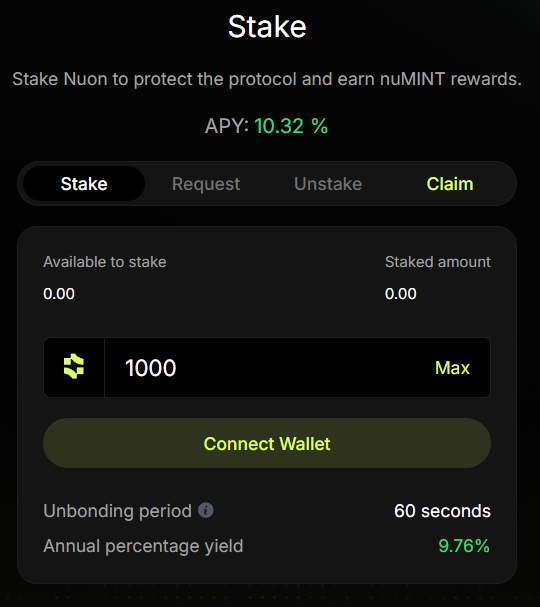

If you are happy to take more risks with Nuon to get more out of the v2 protocol, you can decide to stake your freshly minted Nuon.

Staking Nuon V2 during the Guarded Launch offers a few important advantages:

- You receive a higher yield; the currently estimated APY after the launch is ~9%, but it might reach >40% during the controlled initial deployment.

- With staking rewards shared between fewer early participants, you get a larger piece of the pie.

- You receive your yield in the protocol's new strategy token.

Staking at the Nuon v2 Guarded Launch is one of the few ways to get the strategy tokens early. Another one is joining Nuon's referral program. If you're interested in strategy tokens, staking early guarantees a bigger share of the strategy token rewards and early access to the protocol's strategy allocations.

Risks of staking include the unbonding time. Staking Nuon binds your Nuon for 21 days, which will be shortened to 7 days during the Guarded Launch. If anything major happens at that time, you'll have to wait to unbond your tokens before you can sell your Nuon. Another risk is that the rewards paid in the strategy token will be withdrawable only after the token sale is complete. The tokens already exist in small numbers but cannot be used until TGE.

Where does the yield come from?

In DeFi, we often say: "If you don't understand where the yield comes from, you are the yield."

Building Nuon v2, we made sure that the Nuon holders are not the yield and are insulated from DeFi risks as much as possible.

The ~2-3% current inflation yield paid to Nuon holders comes from protocol allocations into stable-price, yield-bearing assets.

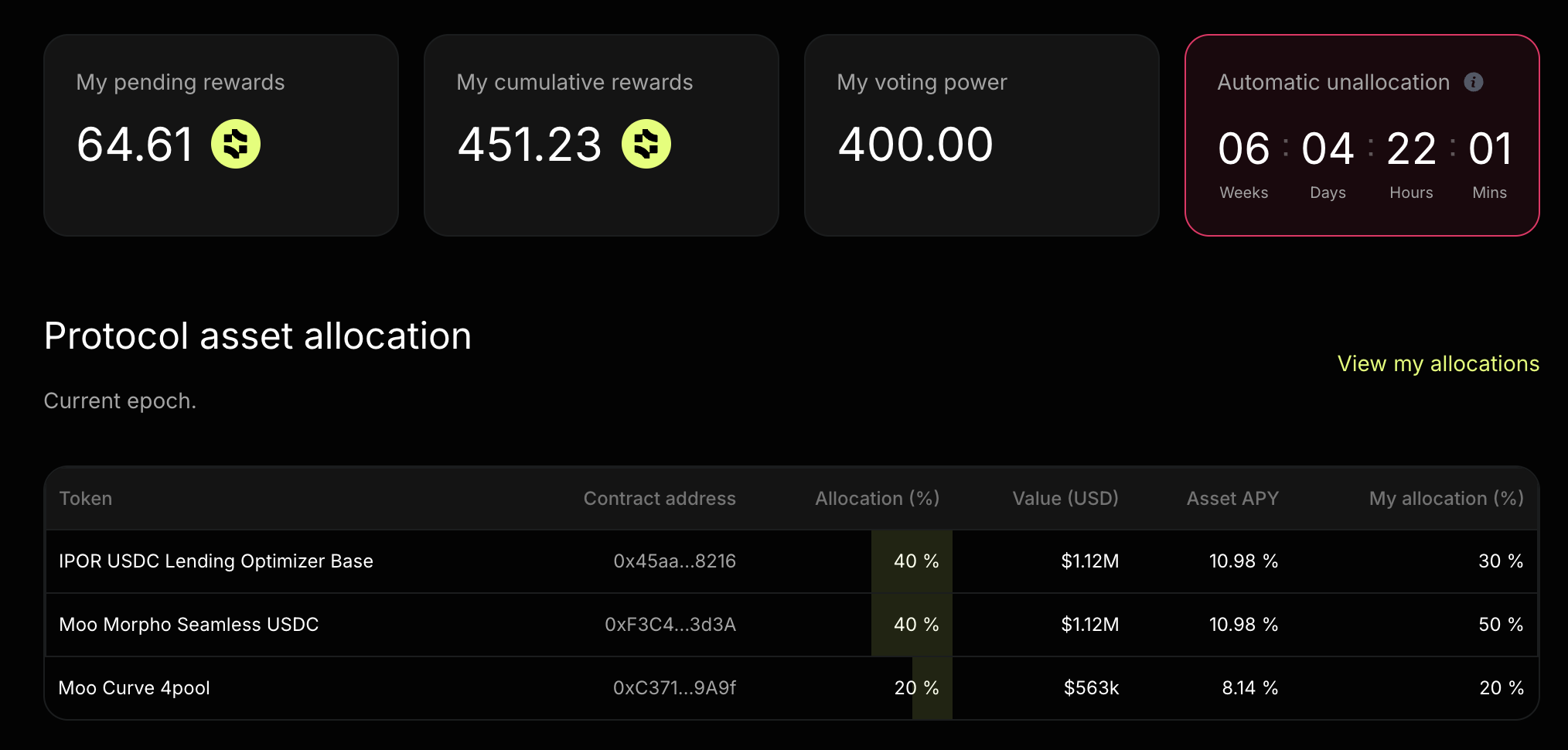

When users deposit USDC into the protocol, it gets allocated into different DeFi protocols that use different stablecoin lending and yield farming protocols to earn yield.

20% of all the USDC remains as a buffer that's allocated into the currently safest and most liquid protocol, AAVE.

Finally, Nuon v2 also directs a percentage of the yields to purchase assets that typically beat inflation in the Reserve.

Is allocating in many DeFi protocols safe?

The Nuon v2 protocol has many built-in economic safeguards to ensure the allocations are diversified and don't lose money:

- Allocations are price neutral: they use other stablecoins for yield farming and thus are insulated from crypto market price oscillations.

- The protocol avoids risky DeFi protocols or protocols with long unbonding times.

- Any assets that shows a loss are automatically unallocated and sold.

So who bears the risks?

Many safeguards are baked into the Nuon v2 protocol, but the allocations and their associated risks lie squarely on the shoulders of the Nuon v2 governance community that we call our Risk Curators.

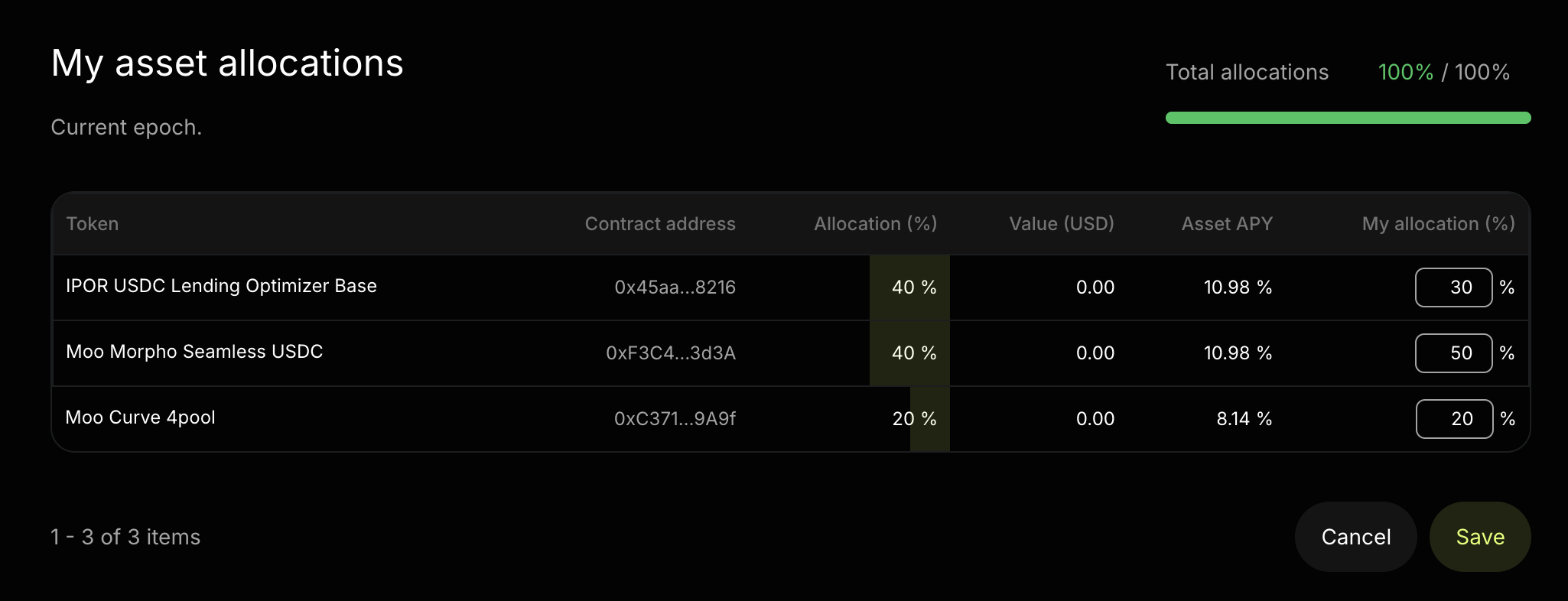

Anyone who stakes the strategy token can become a Risk Curator and start voting on the Nuon protocol allocations for a shot at rewards, although we recommend it only for seasoned DeFi strategists. When they allocate their voting power properly, they should see outsized rewards. However, if they allocate too much risk to the protocol, they lose any gains they made as well as the underlying strategy tokens they staked.

There are no government bailouts for Risk Curators.

How do Risk Curators manage allocations?

Every strategist votes on their protocol's allocations. The sum of the votes is processed by the protocol into a diversified DeFi yield-bearing portfolio. The votes that result in positive yields get a share of the rewards on the total portfolio allocation, but the votes on the losing protocols get their rewards slashed. It creates positive and negative incentives to do a good job researching and betting on the right yield protocols.

What are the benefits for Nuon holders?

Nuon holders bear a very small risk and maintain complete liquidity while receiving a stable ~2-3% yield on their Nuon. This is more yield than the interest offered by saving accounts and it is more than offered by many centralized exchanges without any unbonding time.

Nuon also maintains the benefits of decentralization. It's all non-custodial, and no one can decide one day that you can't access your Nuon anymore.

Nuon holders always remain liquid and can always swap back into USDC.

What are the risks and risk management options?

Nuon allows users to assess their risk appetite and choose how to interact with the Nuon v2 protocol.

In case of some major hit to the DeFi and crypto markets or to Nuon, Nuon holders are insulated, not liquidated. They have enough time and liquidity to exit Nuon if they choose to do so.

In the case of a serious market-wide event, other Nuon v2 participants bear more risks and are part of 3 layers of defense when the protocol's collateralization through yield-bearing assets decreases.

- In return for the highest possible rewards, Risk Curators bear the highest risk. Their tokens are bound for a period of 3m up to 1y, and in case of major events, first their rewards and then their capital could get slashed to save the rest of the protocol users.

- If the losses incurred by Risk Curators doesn't cover the shortfall, the Reserves are sold off

- Finally, Nuon stakers can get slashed as a last resort.

When the total protocol's collateralization drops below 20%, the necessary buffer for the Nuon holders to cash out, the protocol commits honorable seppuku to save the remaining Nuon holders. All remaining assets are converted to USDC and the protocol becomes withdrawal-only.

Summary

Nuon is a stablecoin that offers easy and relatively safe access to DeFi to protect your liquid assets against inflation.

Nuon saves users the effort, and the headache related to DeFi yield farming and insulates Nuon holders from risks related to DeFi protocols and crypto markets.