How to Capitalize on Arbitrage Opportunities with Nuon

As a flatcoin, NUON aims to maintain a stable peg to the US dollar by using a unique quadruple redundancy mechanism.

The redundancy mechanism minimizes governance or human intervention, creating a more stable and credibly neutral system.

One key aspect of the Nuon protocol is the use of arbitrage to accelerate the repeg process and restore the stable peg.

In this article, we will explore how traders can capitalize on arbitrage opportunities with Nuon to generate profits in two case scenarios:

- When the price of NUON is above the target peg

- When the price of NUON is below the target peg

Understanding Nuon's Arbitrage Mechanism

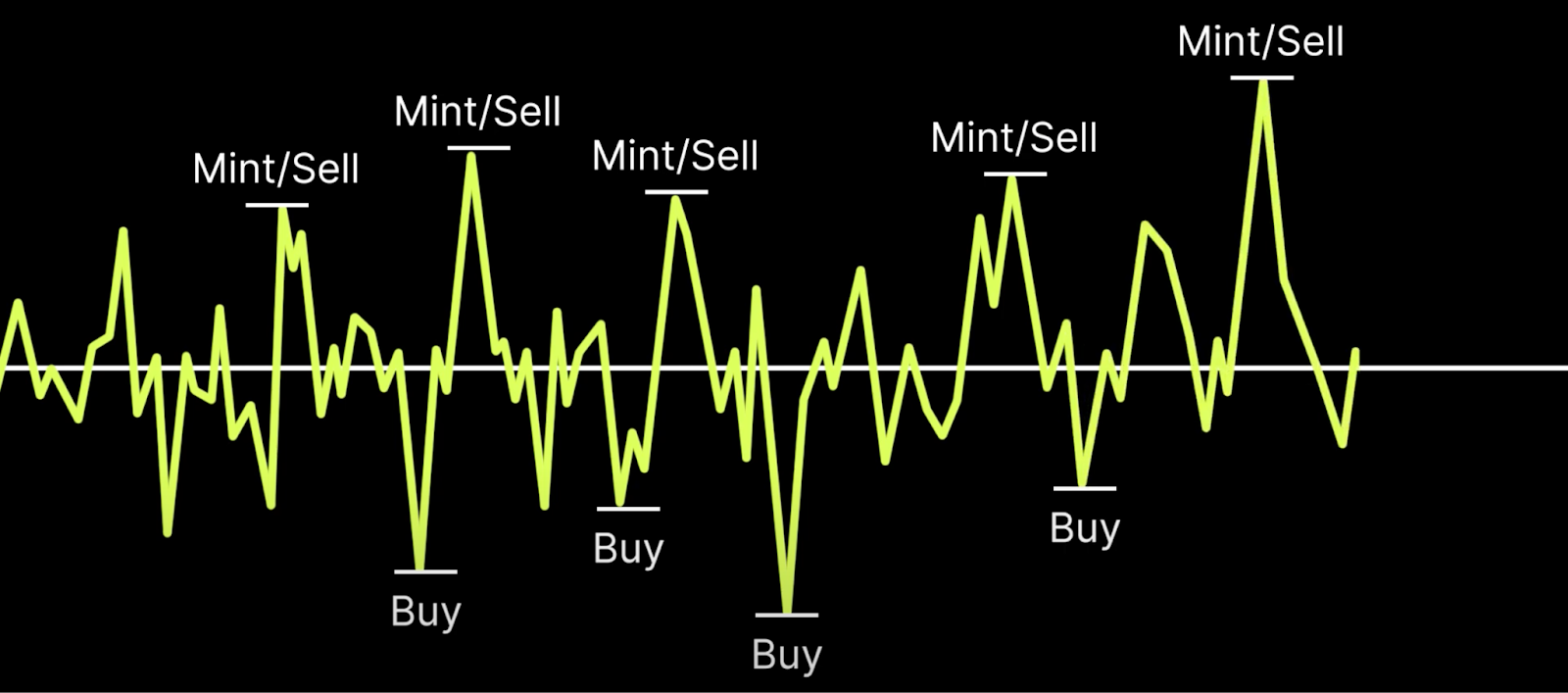

Nuon has a soft peg that allows for minor price oscillations, which then enables arbitrage opportunities.

The Nuon protocol incentivizes users to mint or burn Nuon in response to changes in the Liquidation Ratio. This ratio fluctuates based on changes in inflation rates, Nuon peg divergence, and collateral volatility.

- When the Price of NUON rises above the peg,

It triggers a decrease in Liquidation Ratio (LR), making it more capital efficient for users to mint Nuon and sell it on the market.

As a result, the supply of Nuon on the market increases, causing its price to decrease until the peg is restored.

- Similarly, when the price of Nuon drops below the peg,

the Liquidation Ratio increases, creating a strong incentive for arbitrageurs to accelerate the repeg process.

When the Liquidation Ratio increases, it also increases the risk of liquidation for Nuon Protocol participants.

This, in turn, creates a strong incentive for users to either increase their collateral or burn Nuon to maintain a safe collateral ratio.

Arbitrageurs take advantage of these opportunities by buying Nuon when trading below the peg and selling it when trading above the peg.

By doing so, they help to restore the stable peg and earn a profit in the process.

How to generate profits by watching NUON’s price?

In order to execute NUON arbitrage trades, one must acquire NUON at some point.

There are 2 ways to do that:

a) minting NUON using ETH as collateral or b) buying NUON directly on the market.

📈CASE 1: NUON is above the target peg

Deposit ETH and mint NUON, then sell NUON on the open market to a stablecoin such as USDT.

You will eventually have to repurchase NUON to repay your debt - which will depend on the market to drive the price back down.

If you already have minted NUON, simply swap it using our in-house swap feature for USDT and wait.

Note: if the market price of NUON is above the target peg, your debt will decrease in value (you will own less in $ terms) while you wait because the price will soon come down closer to the target peg.

In this way, arbitrageurs are incentivized to generate more debt and sell NUON on the open market, which helps drive the market price back down.

📉Case 2: NUON is below the target peg

In this case, arbitrageurs are incentivized to purchase

This incentivizes users to deposit more collateral or burn Nuon, which decreases its supply

As above, but conversely, note that if the NUON market price is below the target price, your debt will increase in value (you will owe more in dollar terms) while you wait because the price increases closer to the target peg, if it hasn't already increased.

In this way, you are incentivized to redeem your collateral, burn the supply, and market buy (as the market price is lower than the minting price).

Minters that short NUON also benefit as they'll buy back their NUON lower, maintaining the peg at or closer to the target peg.

In practice, you would want to start by adding Nuon to your watchlist and tracking its activity. Arbitrage opportunities always appear, given the soft peg, so you need to monitor the token’s price and make your move when price oscillations create an opening.

The NUON ‘Dance’

We’ve created the Nuon token with two goals: to hedge against inflation and maintain purchasing power but also to engage in arbitrage opportunities. And these opportunities will become even greater as Nuon liquidity is building up in the market.

Since Nuon’s soft peg rises and falls with inflation rates and the market price depends on trading volume, arbitrageurs will continuously find opportunities to profit.

It is fast, real-time balancing, governance-minimized, and extremely resilient. We strongly believe the NUON protocol can become a foil to Bitcoin's "hard money" narrative to create a trustless flatcoin that the crypto/DeFi community can embrace.