Nuon Integrates IPOR Fusion's USDC Lending Optimizer for Smarter Yields

Nuon Integrates IPOR Fusion's USDC Lending Optimizer on Base for higher yields and enhanced risk management, delivering easy and safe access to DeFi

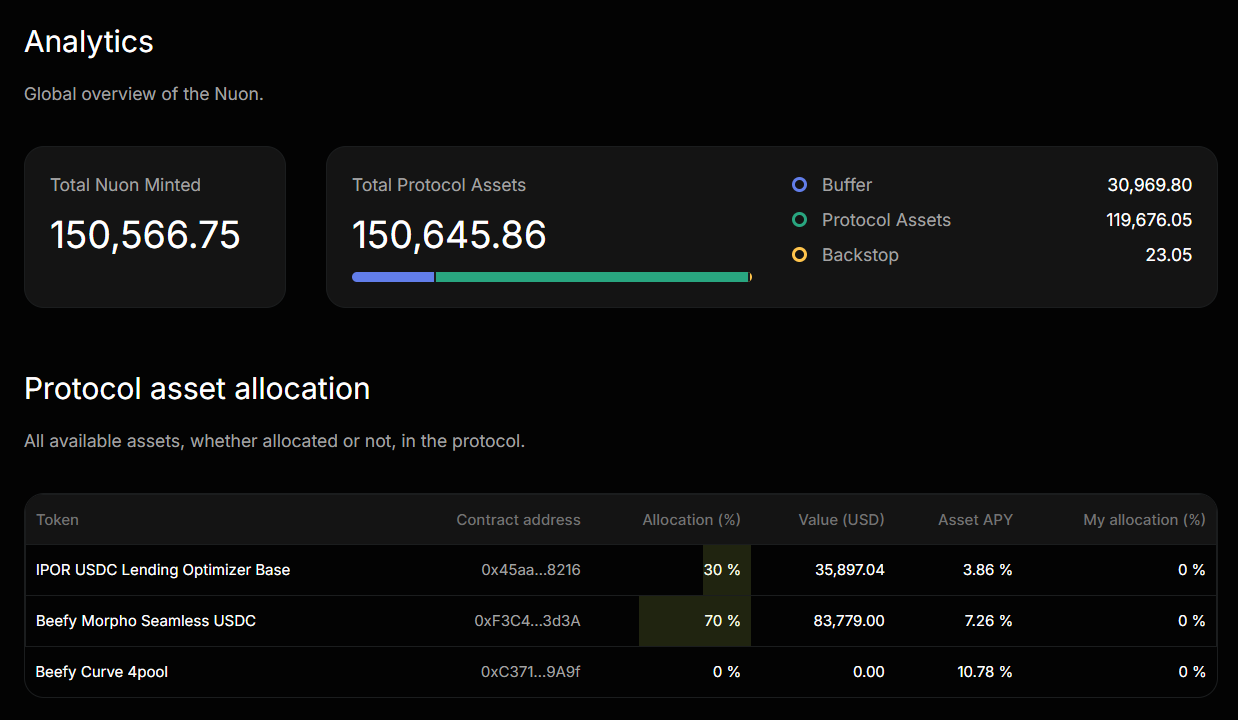

We’re excited to announce that Nuon has integrated IPOR Fusion’s USDC Lending Optimizer into its decentralized asset allocations, now live on nuon.fi. This strategic move enhances Nuon’s yield strategies and inflation protection, with IPOR’s industry-leading smart yield optimization delivering superior returns and institutional-grade risk management.

Why IPOR Fusion's USDC Vault?

IPOR is the gold standard for on-chain interest rate markets, offering unmatched efficiency, transparency, and reliability. The IPOR Fusion USDC Optimizer, available on Base, automatically allocates capital across top lending protocols, maximizing yields while minimizing risk. By integrating this solution, Nuon ensures:

- Higher, more stable yields in nearly all market conditions.

- Complete liquidity and reduced exposure to volatile DeFi rates.

- Enhanced capital efficiency and diversification of Nuon’s asset portfolio.

The Fusion USDC Vault, recently released on Base, optimizes asset allocation across premier money markers and dynamically adjusts to maximize returns. It takes into account market liquidity, APYs, and even gas costs. The Optimizer Vault leverages rate arbitrage and automatically compounds token rewards, leading to an optimized and above-market APY. Despite being relatively new, the IPOR Fusion Vault on Base already has nearly $1.5m TVL, and Nuon Finance is one of the first products built on top of it.

Lot's of alpha to be found this time on @base USDC Optimizer

— Darren Camas | IPOR Labs (@DarrenCamas) March 27, 2025

14.55% spot 8.51% past 7 days outperforming mainnet money markets

Already seeing products built on top of the optimizer like @NuonFinance stablecoin

Instant liquidity, no lockup, no withdraw fee pic.twitter.com/lBZR6WowIQ

Fusion’s Enterprise-Level Security

IPOR Labs’ Fusion is the blue-chip asset management automation infrastructure, delivering highly-optimized yield generation products on-chain. The Fusion protocol’s modular approach ensures high adaptability to the constantly evolving DeFi space while delivering robust security and full transparency, making it the ideal partner for Nuon’s inflation-resistant, risk-adjusted stablecoin.

By integrating IPOR’s Fusion product, Nuon enhances its ability to protect Nuon holders from economic, market, and DeFi risks, including periods of high inflation and diminishing returns or protocol risks associated with the complexity of DeFi solutions.

Nuon x IPOR Labs Vision Alignment

Nuon is dedicated to revolutionizing decentralized finance by providing seamless yet non-custodial, censorship-resistant access to DeFi and real yields. Both Nuon and IPOR Labs share a strong commitment to financial stability, transparency, and decentralized innovation, making this partnership a perfect synergy. The integration reflects our shared commitment to building a more resilient, secure, and yield-efficient DeFi ecosystem.

Summary

IPOR Fusion stands out as one of the most advanced and reliable protocols for on-chain asset management. By incorporating the Fusion USDC Vault on Base, Nuon strengthens its inflation protection mechanisms and generates higher real yields more reliably while maintaining complete liquidity and minimizing risks.

This collaboration allows Nuon holders to benefit from sophisticated hedging solutions and optimized yields at institutional-grade security by simply holding $NUON, reinforcing Nuon’s position as the easiest, most risk-adjusted stablecoin for inflation protection.

About IPOR Fusion

An infrastructure layer for the next generation of DeFi-powered financial products. Offering interest rate benchmarks, derivatives, and automated asset management.

Learn more: ipor.io

About Nuon

Nuon is the decentralized stablecoin hedged against inflation, combining real-world assets and DeFi yield strategies to create a censorship-resistant store of value.

Learn more: nuon.fi