Nuon Yield-Bearing Stablecoin: A Comprehensive Guide

Nuon is a decentralized, inflation-protected stablecoin offering secure DeFi yields, liquidity, and community governance for treasury managers and investors.

TLDR: Nuon is a decentralized, inflation-protected stablecoin that offers secure, liquid access to DeFi yields through a positive rebase mechanism tied to real-time inflation data. It aggregates yield from low-risk, price-stable DeFi strategies while minimizing exposure to crypto volatility and maintaining 1:1 USDC redemption. With layered insurance, community-driven governance, and strong internal security, Nuon provides treasury managers, DAOs, and investors with a resilient, risk-adjusted way to hedge against inflation, earn passive income, and retain full asset ownership within a decentralized ecosystem.

Introduction

In today’s rapidly evolving digital economy, Nuon emerges as a revolutionary inflation-protected stablecoin, offering users seamless access to DeFi yields while prioritizing safety and security.

The guide below delves into how Nuon operates, its standout features, and the strategic benefits it offers to treasury managers, DAOs, institutional investors, and projects seeking a risk-adjusted financial hedge and a source of reliable passive income on their liquid assets.

What is Nuon Stablecoin?

Nuon is a decentralized, non-custodial stablecoin that protects users from inflation by providing them with real yields derived from yield-bearing assets. It is designed to be secure and user-friendly, with the goal of becoming the easiest and safest access to DeFi yields available today.

Inflation Protection Through a Positive Rebase Mechanism

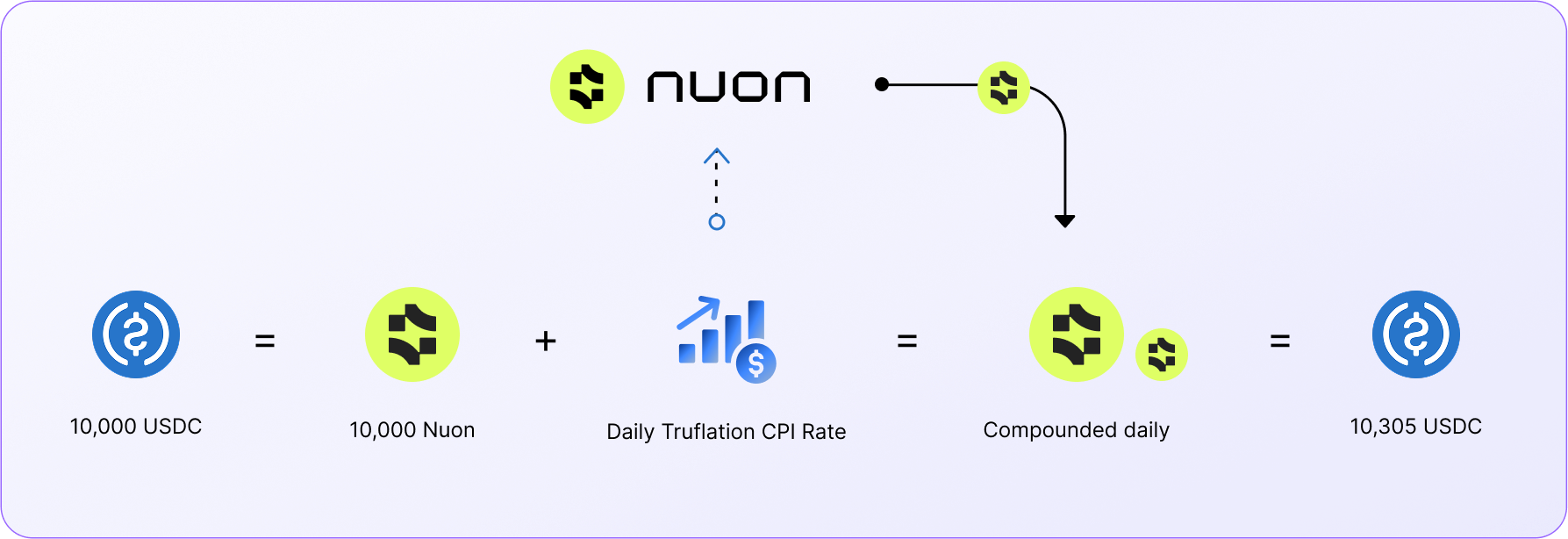

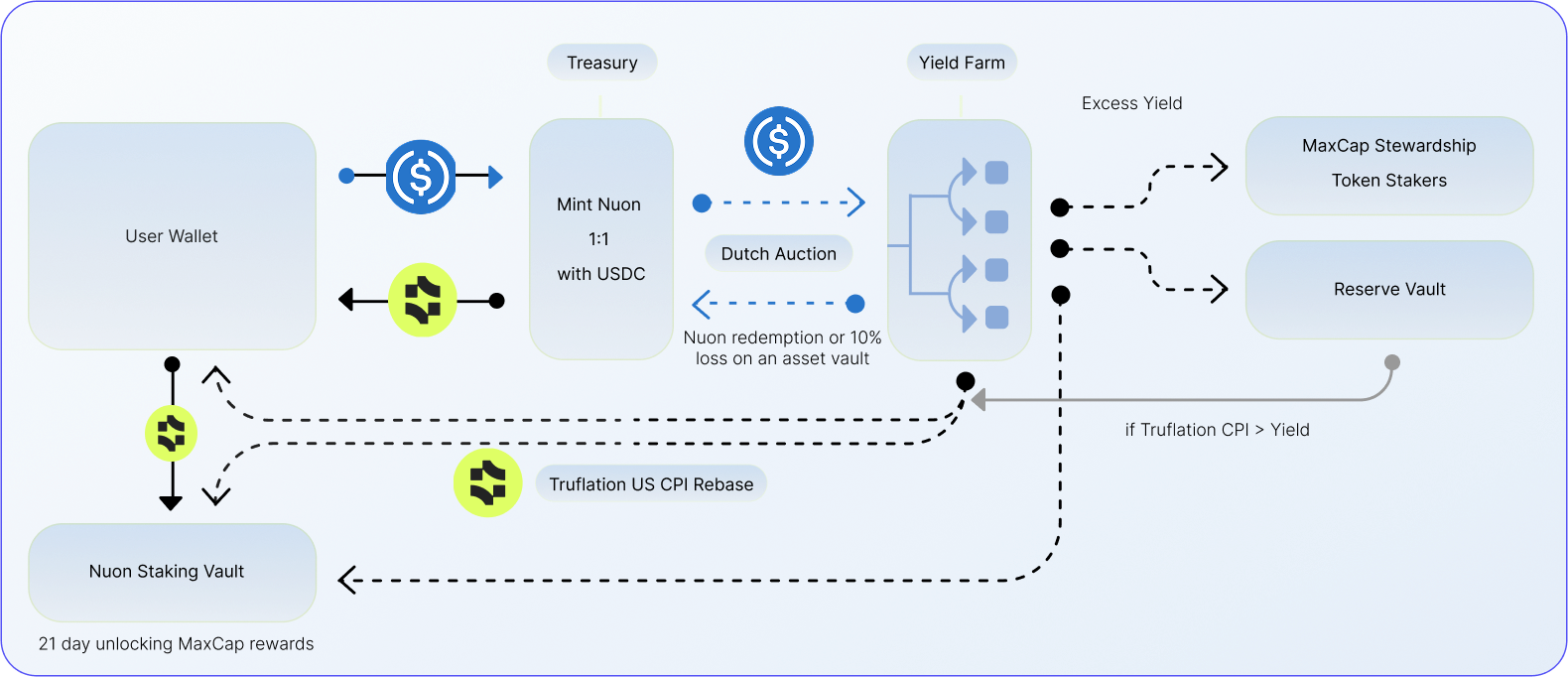

At the heart of Nuon is its inflation-proof mechanism, which ensures that holders receive inflation yields (measured using Truflation CPI rate) directly into their wallets through a positive rebase mechanism.

This mechanism streams extra Nuon tokens into Nuon holder wallets on a daily basis in response to real-time inflation data, allowing users to maintain their purchasing power.

To obtain this basic inflation yield, it's enough to simply hold Nuon in one's wallet where it remains liquid, unstaked and unbonded, and instantly redeemable 1:1 to USDC. This is particularly important in an uncertain economic climate when it's often necessary to keep a % of assets liquid and readily available. With Nuon, it's now possible to earn steady, reliable yields on such assets.

Once added to the wallet, new Nuons are immediately liquid, redeemable for USDC, and able to earn inflation yields, leading to compounding effects from simply holding Nuon stablecoin in your wallet.

The positive aspect of the rebase mechanism means that the amounts of Nuon are only adjusted when inflation occurs. In rare cases of national deflation, when the consumer prices start decreasing and inflation is negative (a rare occurrence because the target inflation of global Central Banks is set at 2%), the rebase mechanism does not adjust the Nuon amounts negatively.

Easy Access to DeFi Yields Aggregation

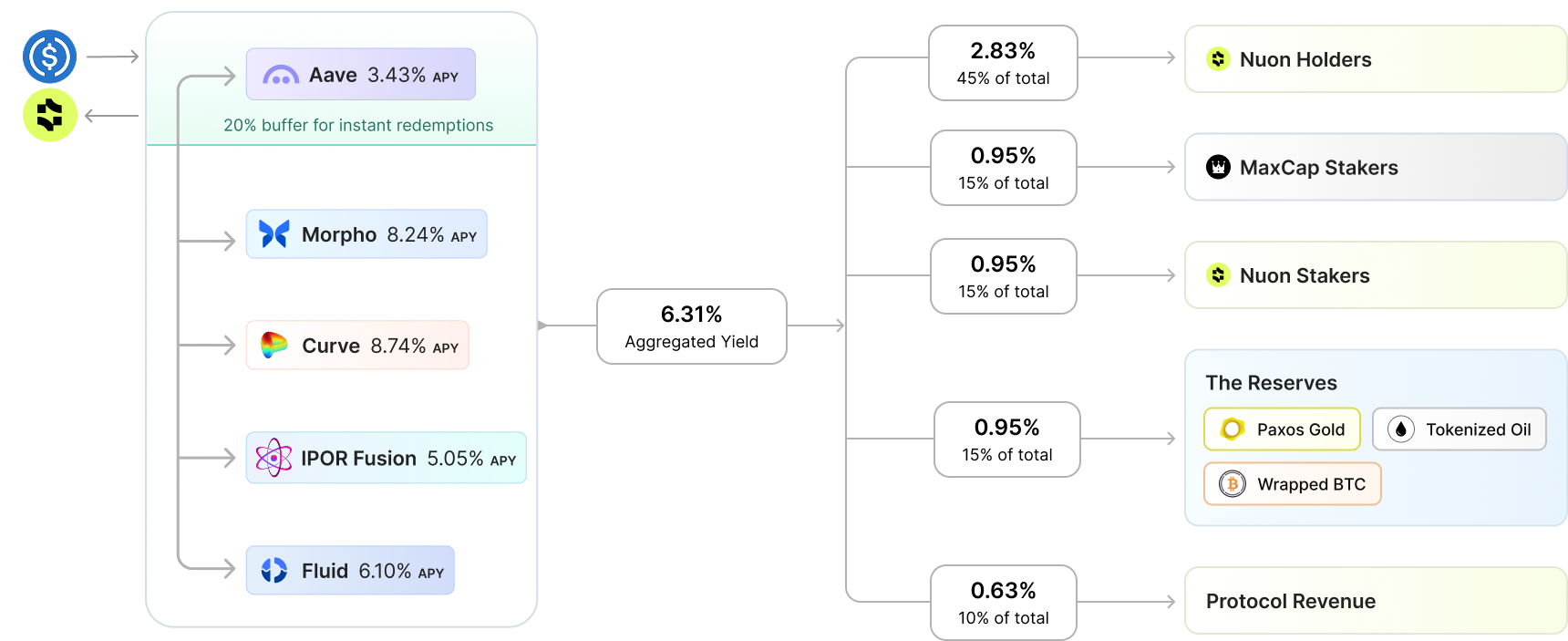

The inflation yields for Nuon holders are currently set at Truflation CPI levels and will likely be expanded in the near future, with Truflation CPI Rate set as a minimum yield. But where does this excess value come from?

When USDC is deposited into the Nuon protocol's treasury to mint Nuon stablecoin, the USDC becomes the protocol's assets and is allocated into various price-neutral, yield-bearing assets, i.e., Aave, Morpho, Curve, or IPOR Fusion.

The assets generate an aggregated yield, which is then distributed firstly to Nuon holders, and then the excess yield to other user groups, namely Nuon stakers, MaxCap token stakers (also called the Stewards of the protocol), and the protocol reserves. The protocol also takes a 10% revenue cut for its maintenance costs.

Price Neutral means that Nuon assets are deposited as a stablecoin into DeFi protocols, i.e., Aave, Curve, or yield strategies, i.e., IPOR Fusion, Midas mEDGE, that use stablecoins to generate yields so that the assets are not subject to crypto price fluctuation. Nuon assets are also never used to purchase native tokens of DeFi protocols, which limits Nuon's exposure to crypto volatility and external protocol risks and prevents a liquidity crunch.

Yield-bearing means that Nuon assets are deposited into various liquidity and lending protocols that often optimize yield generation while minimizing risks, such as the IPOR Fusion's USDC Lending Optimizer. Nuon assets are only allocated into thoroughly researched, low-risk, blue-chip assets that offer institutional-grade security and instant or near-instant redemptions. If the Nuon protocol experiences a 10% price drop of the assets, it is designed to automatically sell the assets via a Dutch auction.

The Safest Decentralized Yield Solution

Decentralized yield farming continues to experience limited adoption, presumably due to potential safety and security issues, as well as a high barrier to entry, even among crypto natives. For most participants, navigating the fast-paced DeFi landscape and identifying reliable, consistent yield-generating assets has simply proven too complex and overwhelming.

At the same time, outsourcing the yield generation to centralized entities has proven equally, if not more, dangerous. Numerous high-profile collapses, from rug pulls and fraud to hacks and market attacks, have led to bankruptcies and catastrophic failures, such as those seen with Celsius Network, FTX, and the many yield products tied to the Terra Luna ecosystem.

In this environment, Nuon is actively delivering on the critical mission of building a safe, decentralized yield engine, one that democratizes access to yields and inflation protection, drives broader Web3 adoption, and upholds the core principles of the blockchain movement, freedom, true asset ownership, and community-driven governance. It does so by addressing multiple different safety and security aspects of yield-bearing stablecoin.

External Protocol and Market Risks

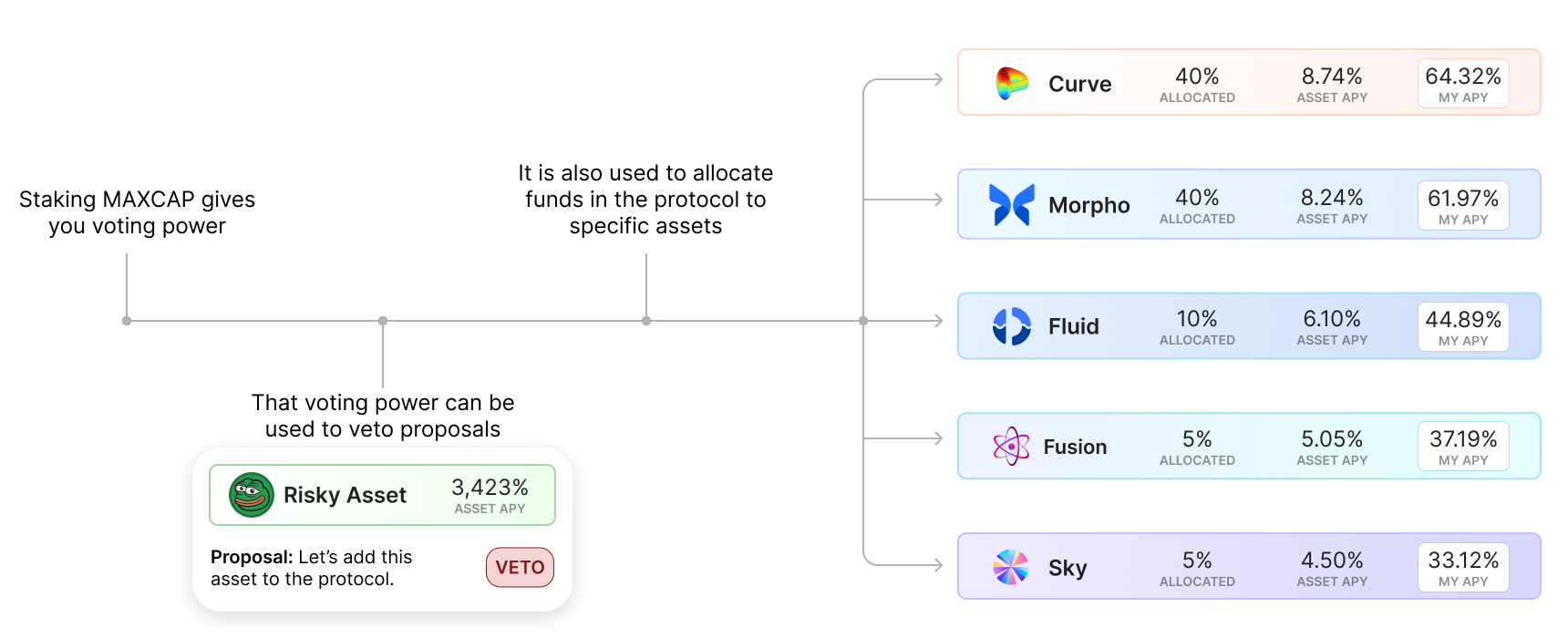

In essence, Nuon works as a DeFi aggregator with a unique, community-governed decentralized asset allocations engine, multiple built-in economic security features, and 3 insurance layers insulating the Nuon stablecoin holders from risks.

As an aggregator, Nuon needs to address potential protocol and market risks coming from exposure to various yield-bearing DeFi protocols, which are also chosen by the community, another vector for a potential attack. It does so in multiple ways:

Allocation Requirements - only certain types of allocations are allowed to be submitted for the community's approval, starting with price-stable assets and excluding native tokens of the protocols.

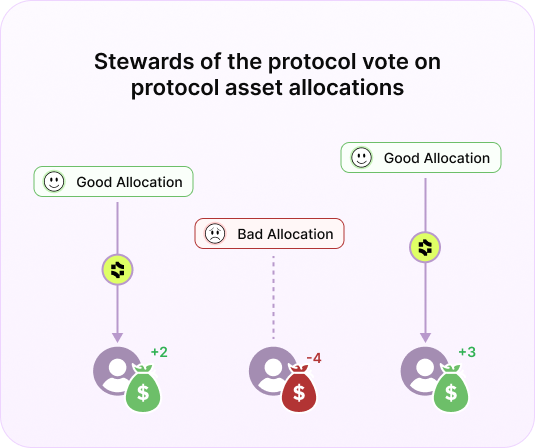

Stewardship Governance and Incentive Design - allocations are voted on by the protocol's Stewards, who own and stake MaxCap tokens to obtain voting power and access to the share of rewards. Stewards of the protocol take on the bulk of the risk and burden of researching allocations and choosing the best yield-bearing assets. The MaxCap incentive design is constructed in such a way that voting on the best assets is highly beneficial while voting on the losing assets is costly. Serial offenders can also be curtailed by other Stewards.

Risk Curation and Allocations Vetting - a group of 10 Risk Curators among the most influential and yield-savvy crypto natives are invited to become Risk Curators of the Nuon protocol. The Risk Curators are Stewards of the protocol who actively engage with the community, submitting proposals, participating in community discussions, pre-vetting the most interesting yield-bearing assets, and assessing their risk levels.

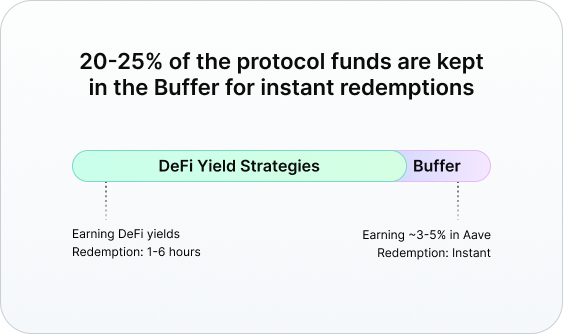

Liquidity Buffer - 20-25% of the protocol funds are kept in a liquidity buffer to enable instant Nuon to USDC redemptions in case of a market crash and bank runs. The Buffer portion of the Nuon assets is allocated into the highly liquid Aave vault, allowing for instant redemptions on Aave, which in turn allow instant redemptions from Nuon to USDC while still earning steady yields of 3-5% (as of Q1 2025).

Automated Dutch Auction Sales - Nuon assets are allocated with highly liquid DeFi assets that often offer instant or near-instant redemptions and additional liquidity safeguards. This facilitates a quick exit from DeFi allocations back to USDC, not only when users redeem Nuon for USDC but also in case of any significant market or external protocol crashes. The protocol is also designed to automatically sell assets that incur 10% losses via a Dutch auction and proceed to recover the funds from the protocol's layers of insurance.

The Insurance Layers of the Protocol

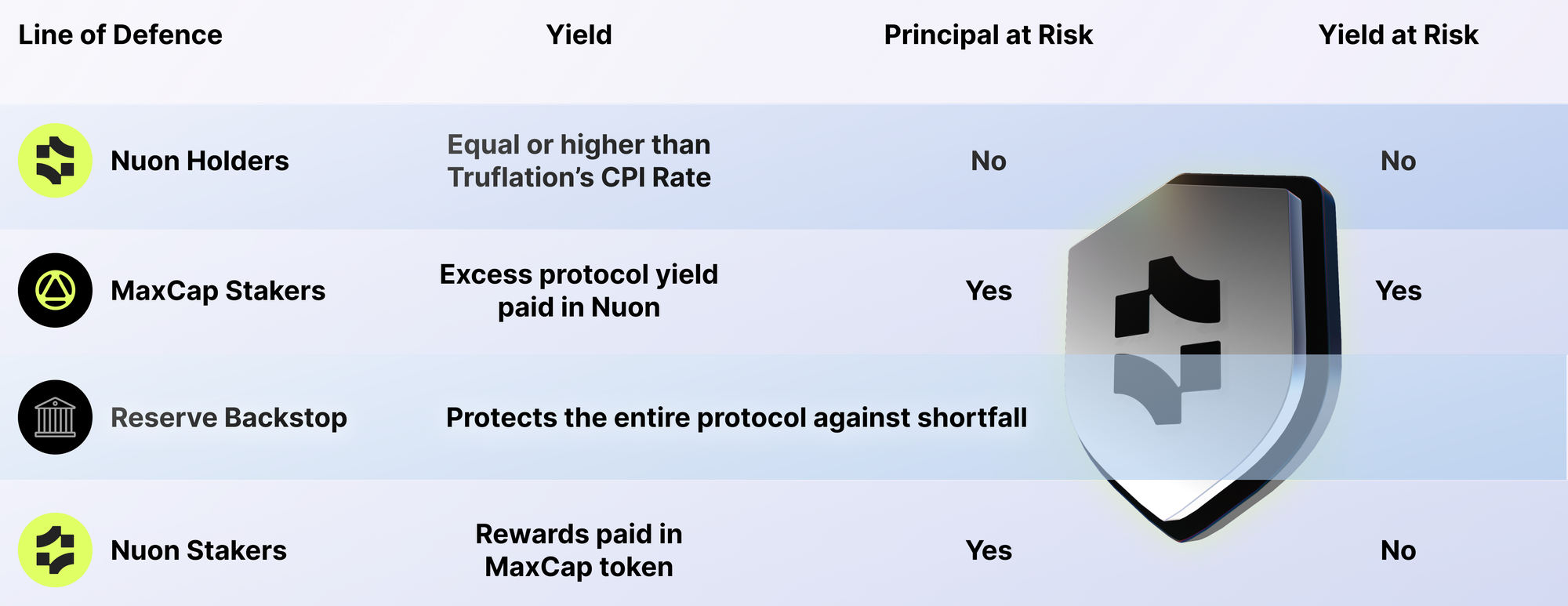

A key feature of Nuon is its insurance mechanism, designed to provide additional protection for users engaging with the protocol at different risk levels.

The most risk-averse and risk-insulated users are Nuon holders. They obtain steady, reliable, low to mid-level yields without needing to stake and lock up Nuon. They retain full ownership and liquidity of their tokens at minimal risk. This is a perfect option for DAOs, treasury managers, and teams seeking to remain liquid while earning yields. The capital and yields earned by holding Nuon are not at risk. Nuon holders' exit to USDC is guaranteed by the liquidity buffer.

All other protocol users are subject to more risk but also gain higher rewards.

- MaxCap Stakers gain the highest rewards at the highest risk. They are a minority of users who are exceptionally crypto-savvy and risk-prone and agree to stake their MaxCap token in exchange for voting power. As the Stewards of the protocol, their role is to research yield protocols and actively participate in asset allocations to asset vaults proposed by the community through a lightweight veto system. In exchange, MaxCap Stakers receive a percentage of the excess yield earned on the protocol's assets allocated to the vaults they voted on. The MaxCap stakers' rewards are high, but they also bear a lot of responsibility. If the protocol suffers an attack, liquidity crunch, or insufficient yields, the MaxCap Stakers' rewards and sometimes also their principal are the first line of defence that gets used to cover the protocol's losses, particularly when caused by the Stewards' poor allocation choices.

- Reserve Backstop is a protocol allocation into tokenized RWAs and inflation-correlated assets aimed at securing liquidity during difficult economic and market situations. In case of a bigger market or protocol failures, the reserve is used against liquidity shortfalls and yield losses, or when the generated yield is not sufficient to cover inflation yields for Nuon holders.

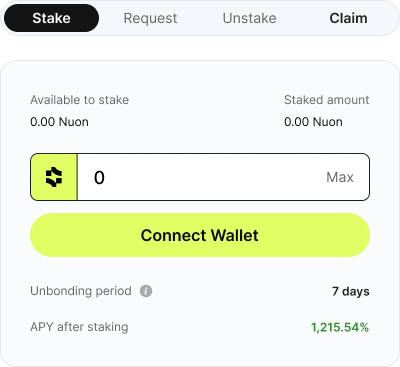

- Nuon Stakers partake in an extra percentage of the excess yields generated by the protocol, but in exchange, they lock their capital for 21 days, and they agree to insure the protocol. Their Nuon yields accrue where their Nuon is stored, so in case of a hack, liquidity crunch, or market crash that affects the viability of the protocol, both their capital and rewards are at risk and can be used to ensure the safe exit for the Nuon holders. Nuon Stakers are medium-to-high risk-reward ratio users and agree to serve as the last line of defence in case of serious events.

Internal Protocol Security

Finally, Nuon is also well equipped to tackle the internal protocol security threats related to smart contracts, data oracles, protocol integrations, cross-chain bridges, governance attacks, and other potential vectors of attack common in Web3 protocols.

Our dev team collaborates with renowned security and Web3 experts, early adopters, and stakeholders to incorporate various institutional-grade security measures, smart contract audits, careful token distribution and incentive design, community initiatives, and other measures to protect Nuon against vulnerabilities.

- Smart Contract Audit with Decurity - successfully completed December-March 2025

- Nuon Audit 2 - nearly completed

- Guarded Launch Live Testing - completed

- Bug Bounty - recommended as a security initiative by Decurity and launched

- Safe Multisig Wallet - successfully integrated internally and in the Nuon UI

- Chainlink Price Feeds and Automation - integrated

- TRUF Network data validation - integrated

- Chainlink CCIP for cross-chain transactions - implementation in progress

Although launched on Base blockchain, Nuon actively works to implement on other blockchains and become chain-agnostic using Chainlink's CCIP.

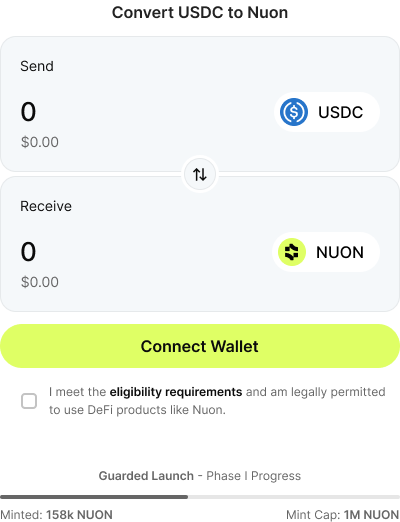

Where to get Nuon

Nuon is not yet listed on CEXs or DEXs. The only way to get Nuon is by minting it on our website and app through the Nuon protocol treasury. This is also the place to redeem your Nuon 1:1 to USDC.

To mint Nuon, follow our step-by-step instructions in the Nuon docs.

Where to Get MaxCap Governance Token

MaxCap is the Nuon protocol's native governance token. When staked, it enables users to obtain voting power and access to decentralized allocations and a related share of the rewards.

MaxCap is currently pre-TGE and not available on exchanges. The only way to obtain MaxCap is through staking Nuon during the Guarded Launch or purchasing it during the upcoming Private Sale, subject to lockup and vesting periods. After that, the token will be listed on DEXs (date TBD).

For investment inquiries, please contact us at info@nuon.fi.

Conclusion

Nuon offers a fundamentally new approach to stablecoins by combining inflation protection, decentralized yield aggregation, and layered security into a single, user-friendly platform. By addressing major risks in DeFi, from asset volatility to governance and protocol failures, Nuon provides a safer, more reliable solution for treasury managers, DAOs, institutional investors, and individual users seeking steady returns without sacrificing liquidity or security.

With its built-in insurance mechanisms, transparent governance model, and strong internal protections, Nuon stands as a resilient foundation for users who demand both stability and yield in the evolving Web3 economy.