How Stablecoins Are Reshaping High-Inflation Economies

We are witnessing a global wave of bottom-up stablecoin adoption in high-inflation countries, underscoring the need for more stable and reliable alternatives to fiat.

Fiat Instability is Driving a Global Stablecoin Shift

Across emerging markets plagued by inflation and unstable currencies, a major shift is underway. In countries like Argentina, Venezuela, Turkey, and Nigeria, people are no longer waiting for governments or banks to preserve their wealth. Instead, they are adopting stablecoins pegged to USD at record rates. This isn’t speculation. It’s a self-preservation, as citizens seek new methods to escape high inflation, currency depreciation, bank freezes, and remittance costs.

As we examine the data behind this macro shift toward global stablecoin adoption across emerging markets, it becomes clear: stablecoins aren’t just financial instruments; for many nations, they are becoming lifelines, crucial tools for wealth preservation, and a relatively easy means of accessing USD outside of the banking sector or direct government oversight.

Stablecoins Are Driving the Crypto Adoption (Again)

The increased use of stablecoins is now spearheading broader cryptocurrency adoption, onboarding more users into DeFi opportunities, much like it did during the 2020 DeFi boom, except with a significant influx of institutional money as businesses recognize the opportunities of stablecoins going mainstream.

At the same time, the grassroots adoption across many emerging economies is positioning those who embrace the shift as pioneers and leaders in generational wealth creation, as well as in blockchain technology, potentially setting the stage for the next generation of safer and more stable money.

Let's take a closer look at the stablecoin market and its adoption, particularly in Latin America and Africa.

Stablecoin Growth Predictions Are Off-the-Charts

The global stablecoin market reached a market cap of over $200 billion in 2025, surpassing its 2022 record. According to the recent estimate, Citi projects that the stablecoin market could reach $1.6 trillion by 2030, and in a high-growth scenario, the market could expand to $3.7 trillion, surpassing the current total crypto market cap.

Emerging Economies Are Willing to Pay a Premium for Stability

The BVNK report analysing data from Cebr, Yahoo Finance, Binance, and Juniper Research, projects that the stablecoin premium paid across 17 emerging economies will increase from $4.7 billion in 2024 to $25.4 billion by 2027, reflecting the significant premium users in those countries are willing to pay for access to dollar-pegged stable assets. Those are not just emerging markets, but markets where local currencies are more volatile and less stable than the dollar.

This projection suggests that stablecoin adoption will continue to accelerate in less stable, often high-inflation economies, potentially becoming an even more integral part of everyday life. As formal banking systems struggle with currency devaluation and inflation, stablecoins are increasingly filling the role of reliable stores of value and means of exchange, in many locations also enabling banking for the otherwise unbanked.

Adoption Surges in Latin America and Africa

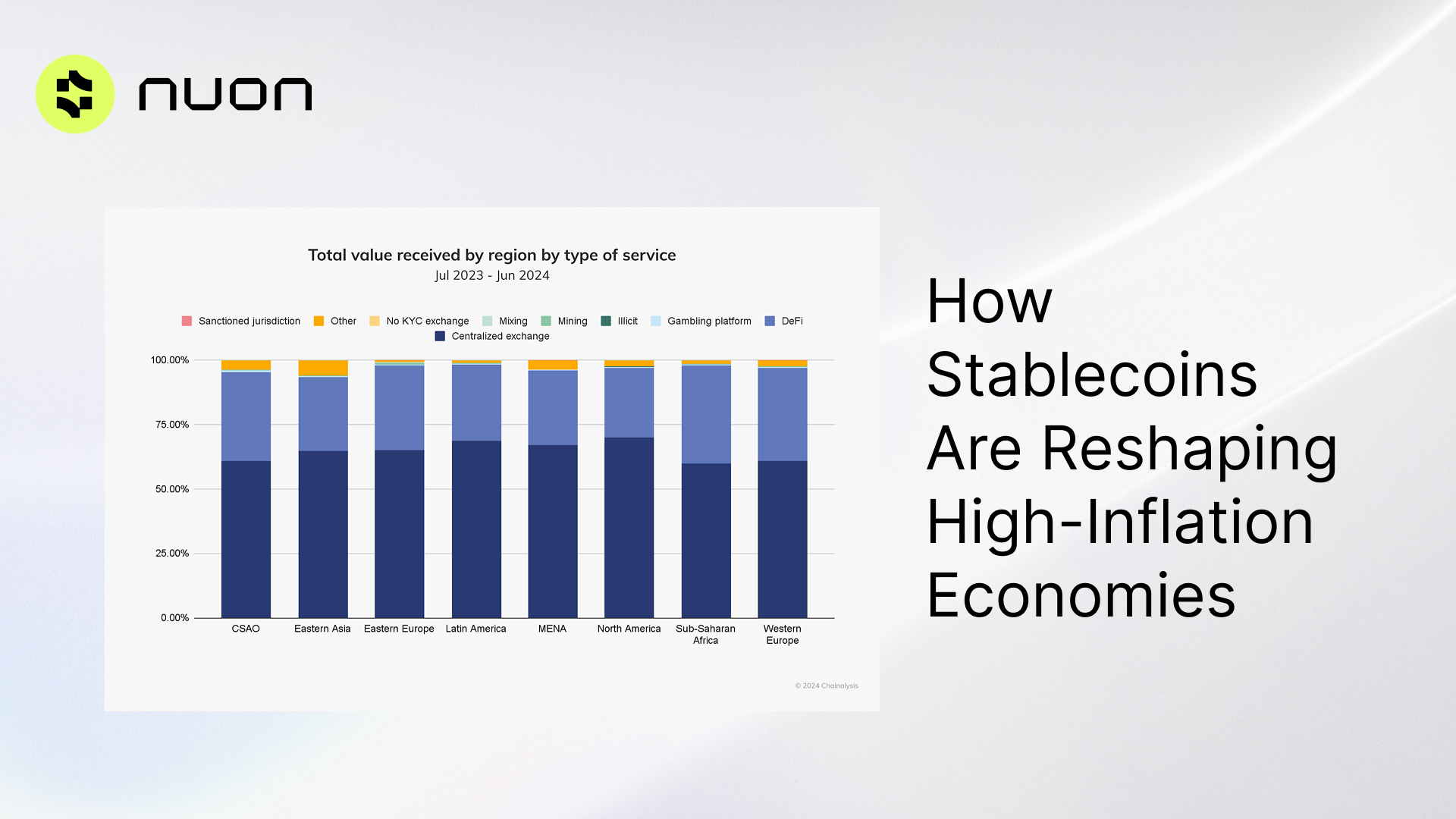

Stablecoin markets experienced unprecedented growth in emerging economies of sub-Saharan Africa and Latin America, leaving previous main adopters, Western Europe and North America, behind (Chainalysis 2024).

Latin America is one of the clearest examples of this transformation. Chainalysis reports that between July 2023 and June 2024, the region received $415 billion in crypto transactions, and Bitso’s March 2025 data shows that 39% of all crypto transactions in the region were stablecoins—a 9% increase from the previous year.

Sub-Saharan Africa is rapidly becoming one of the most dynamic regions for stablecoin adoption, driven by persistent inflation, limited access to formal banking, and high mobile penetration. While the region’s overall crypto transaction volume may trail behind that of Latin America, with $117.1 billion received in crypto value between July 2023 and June 2024, it's important to note that the majority of this volume was transferred through peer-to-peer by mobile-first, grassroots users, showing incredible levels of end-user adoption. Additionally, three countries in this region ranked in the top 20 worldwide in crypto adoption according to Chainalysis.

High-Inflation Countries Are Leading the Charge

The increased adoption of crypto and stablecoins was often correlated with economic, political turmoil, or high and prolonged currency inflation, for example, in Argentina, Venezuela, Turkey, and Nigeria, among others.

After years of double-digit inflation of the local Naira, in 2024, Nigeria ranked first in Africa and second worldwide in blockchain adoption according to the Chainalysis Global Crypto Adoption Index. It came close behind India and ahead of Indonesia and the US in 4th position. Between June 2023 and June 2024, Nigeria received nearly $60 billion in cryptocurrencies, of which 43% was in stablecoins.

Argentina, which reached a peak inflation rate of 292% in April 2024, received nearly $100 billion in cryptocurrencies between 2023 and 2024, over 62% of the transactions involving stablecoins. Brazil closely followed with 59.8% of transfers in stablecoins. Other Latin American countries also showed unprecedented cryptocurrency usage levels, often linked to years of inflation and economic uncertainty, but also correlated with other factors, such as the remittance levels in Mexico and Colombia.

It was, however, Turkey that led the highest fiat stablecoin purchases as a share of GDP between April 2023 and March 2024, reaching a record 4.3% of its GDP, with the US and Europe far behind (Chainalysis Crypto Spring Report). If one were to trust the official Turkish government data on the national inflation that was sometimes being suppressed and faced allegations of tampering, in the last 5 years, the Turkish Lira lost about 85% of its value against the USD dollar.

Turkey also took third place globally in the total value of fiat purchases of stablecoin, despite devaluation and difficult economic and political circumstances. Turkey's population is 83 million, 9 times lower than Europe's and 4 times lower than the US's, which unsurprisingly leads in this category.

Summary

The surge in stablecoin adoption across high-inflation economies is no longer a trend—it’s a structural shift. The widespread adoption of stablecoins in less stable fiat economies has significant implications for monetary sovereignty, financial inclusion, and economic stability. As formal banking systems struggle with currency devaluation and inflation, stablecoins are increasingly filling the role of reliable stores of value and means of exchange. As inflation persists in these regions, stablecoin usage is likely to continue growing, potentially reshaping financial behaviors towards cryptocurrencies, increasing understanding of both economics and technology, and the emergence of entrepreneurial spirit, all leading to economic prosperity and growth.

Nuon’s Role in the Flight to Stability

For Nuon, an insured yield-bearing stablecoin designed to protect against inflation, the stablecoin transformation in high-inflation countries validates our core mission to protect wealth with a safe and insured alternative to fiat that also provides easy access to DeFi yields as a form of passive income.

Nuon's censorship resistance and inflation hedging ability are tailored to users in economies with unstable currencies.

Start taking advantage of Nuon today. Simply mint and hold to receive yields automatically to your wallet, no staking, no lockups.